child care tax credit schedule

Advance Child Tax Credit. Get your advance payments total and number of qualifying children in your online account.

Biden S Child Tax Credits Quietly Underwrite Family Expenses Whyy

The new tax credit was.

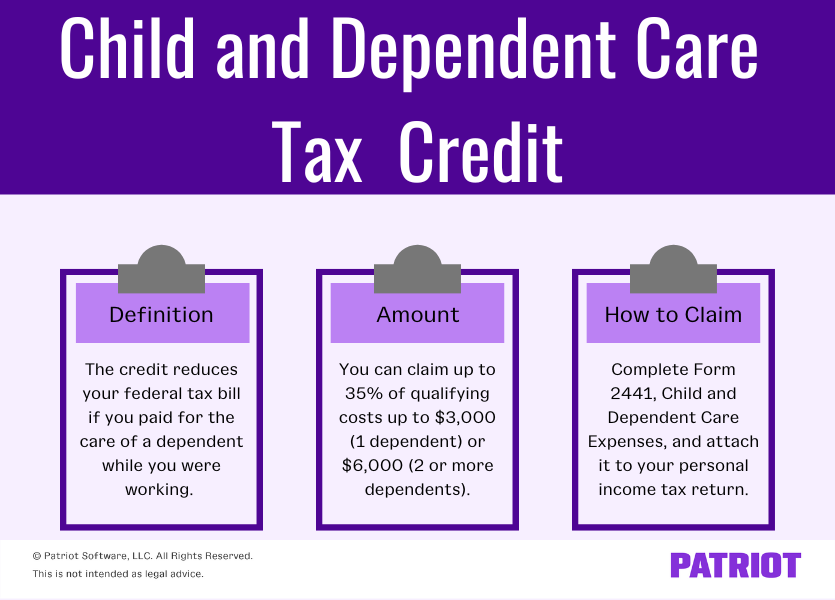

. About Form 2441 Child and Dependent Care Expenses If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could. Heres an overview of what to know. File Schedule ELC and Schedule S Supplemental Information and Dependents.

Canceled checks or money orders. 15 opt out by Aug. To reconcile advance payments on your 2021 return.

For 2021 the credit figured on Form 2441 Child and Dependent Care Expenses line 9a is unavailable for any taxpayer with adjusted gross income over 438000. If your child is not a qualifying child for the Child Tax Credit you may be able to claim the 500 Credit for Other Dependents for that child when you file 2021 your tax return. However you may still.

Ontario Child Care Tax Credit rate calculation. 50 of the total amount spent establishing a child care facility primarily used by dependents of the. Thanks to the American Rescue Plan for this year only families can receive a Child and Dependent Care Credit worth.

While a 300 monthly child tax credit is far from the average monthly childcare center cost of 89658 and 65725 for family-based childcare center President Biden has. The Instructions for Form 2441 explain the. Depending on their income taxpayers could write off up to.

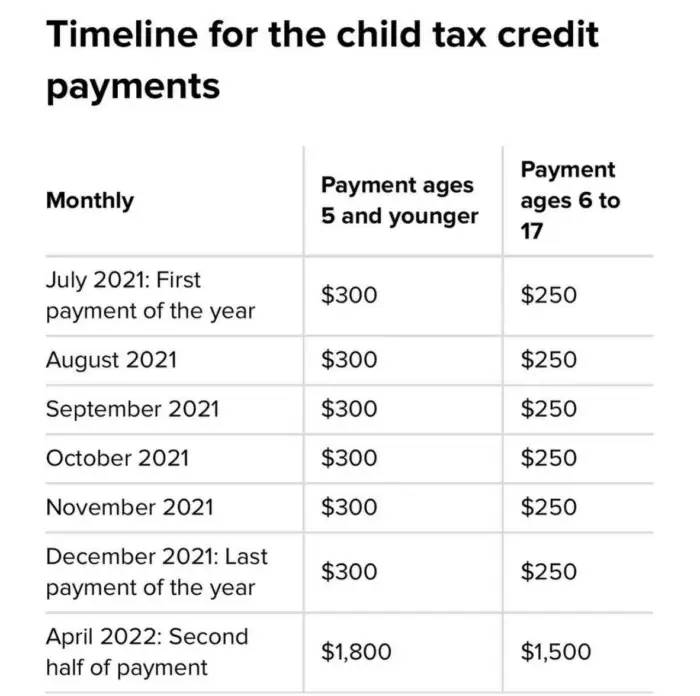

13 opt out by Aug. Starting July 15 and continuing through December 2021 the new federal Child Tax Credit in the American Rescue Plan Act provides monthly benefits up to 250 per child. Unless Congress takes action the 2020 tax credit rules apply in 2022.

HARRISBURG Gov. For example if your income is 10000 your Ontario Child Care Tax Credit rate will be 75. The maximum child tax credit amount will decrease in 2022 In 2021.

By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes. The credit for this qualifying expense would be capped at 30000. For tax year 2021 the maximum eligible expense for this credit is 8000 for one child and 16000 for two or more.

For 2021 the American Rescue Plan Act of 2021 enacted March 11 2021 made the credit substantially more generous up to 4000 for one qualifying person and 8000 for. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. You will need the following information if you plan to claim the credit.

Tom Wolf has approved a new permanent child care tax credit that will allow families to claim thousands of dollars in benefits. The amount of credit you receive is based. Enter your information on.

To claim the child and dependent care credit you must also complete and attach Form 2441 Child and Dependent Care Expenses. Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit NOEC and Ontario sales tax credit OSTC All payment dates January 10 2022. Cash receipts received at the time of payment that can be verified by.

If your income is 45500 your rate will be 55. In order to claim the Keep Child Care Affordable Tax Credit you must complete the following. Up to 4000 for one qualifying person for example a dependent.

Child And Dependent Care Credit Reducing Your Tax Liability

Child Tax Credit What Families Need To Know

1040 Schedule 3 Drake18 And Drake19

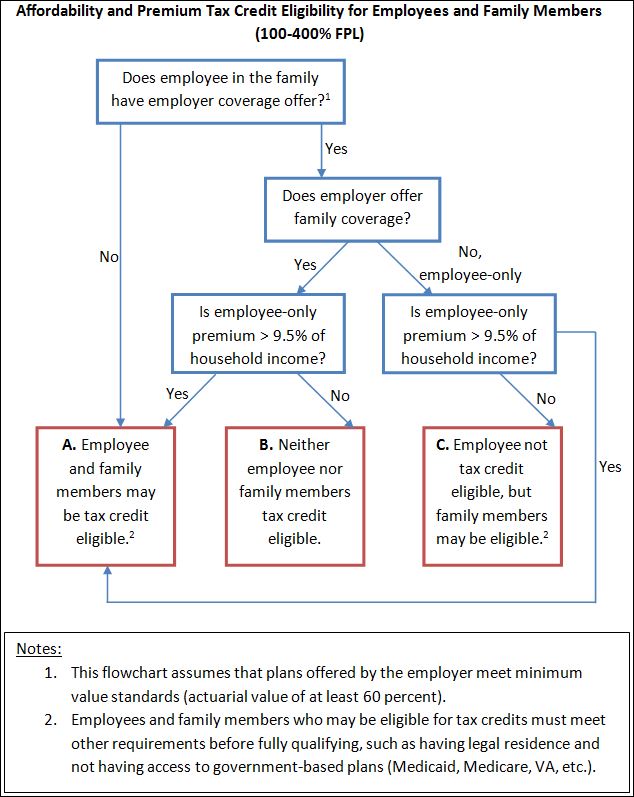

The Most Confusing Source Of Premium Tax Credit Eligibility Made Simple In One Chart The Incidental Economist

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Tax Credit Ronald Mcdonald House Charities

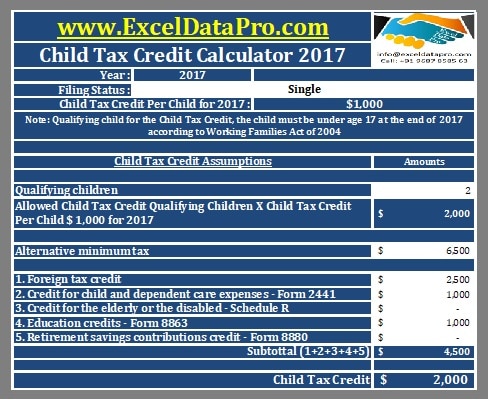

Download Child Tax Credit Calculator Excel Template Exceldatapro

Childcare Contribution Tax Credit Special Kids Special Families

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

2021 Child Tax Credit Earned Income Tax Credit Child Dependent Care Deductions Alabama Cooperative Extension System

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

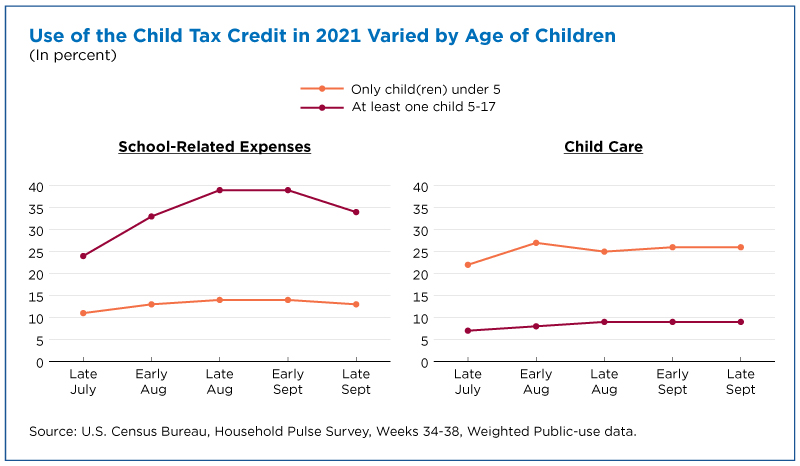

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

What Is The Child Tax Credit Tax Policy Center

What To Know About The First Advance Child Tax Credit Payment

How To Claim The Child Tax Credit Up To 8 000 For Child Care Expenses Nextadvisor With Time

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout